Managing your debt

Have a credit card balance that isn’t going down? A store card with an interest-free period that’s ended... or maybe a personal loan at a high interest rate?

Time to reset your debt!

With the cost of living impacting how much money Kiwis have left after paying their bills, many are cutting subscriptions and hunting out better deals for utilities. If debt repayments make up part of your budget, you may be able to get a better deal on that too.

Credit and store cards can be easy to get but hard to get rid of. Being able to redraw on credit card repayments means you’re not making a dent and just spending more on interest.

Maybe you got a GEM card last year to take advantage of a sweet interest-free deal… and it’s now rolled to a nasty high interest rate. These types of cards often also have annual fees that add more to how much you owe.

What difference could debt consolidation make?

To help answer this, we're going to use an example. Let’s say you have a couple of cards and set a goal to pay them both off in 5 years. You write down the amount owing on each and the interest rate being charged. You owe:

💳 $10,000 on a credit card at 20.95% per annum, and;

💳 $5,000 on a store card that has no interest-free period left... so the interest rate is 28.50% per annum (ouch).

Using the Sorted Debt Calculator, you work out you'll need to pay $188 per fortnight across both cards to reach your debt-free goal of 5 years.

You call this Plan 1.

The next step is to see if there'd be a difference if you bundled the full $15,000 into a Police Credit Union 1Loan. Right away you see you'll be charged a much lower interest rate if you go with a secured loan! The rate you receive will depend on what you can use as security:

🪙 Police Super (PSS) secured - 10.50% p.a.

🚗 Motor vehicle secured - 12.95% p.a.

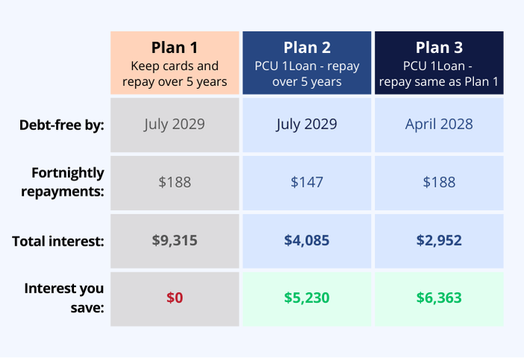

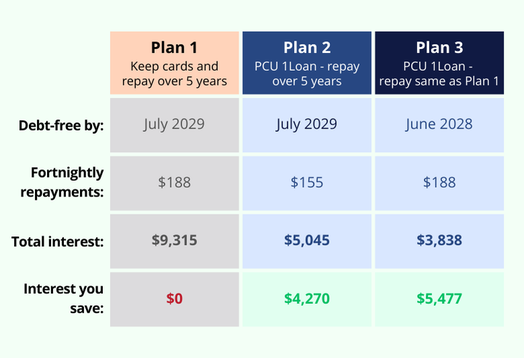

Now it's time to compare your options. You decide on comparing against three plans, all of them starting on 1 July 2024. The difference each plan makes depends on which secured rate you can use.

- Plan 1 is keeping your cards and making repayments to have them both paid off in 5 years.

- Plan 2 is a PCU personal loan with the same goal of being debt-free in 5 years.

- Plan 3 is a PCU personal loan with the same repayment amount as Plan 1 to help you reach your goal faster.

🪙 PSS Secured at 10.50% p.a.

Compared to Plan 1 you could either:

- Pay $41 less in repayments each fortnight and save over $5,200 in interest; or

- Be debt-free in 3 years and 9 months and save over $6,300 in interest.

🚗 Motor vehicle secured at 12.95% p.a.

Compared to Plan 1 you could either:

- Pay $33 less in repayments each fortnight and save over $4,200 in interest; or

- Be debt-free in 3 years and 11 months and save over $5,400 in interest.

Ready to reset?

If you’re ready to stress less about your debts and start the journey towards being in control and debt-free, you can get started now!

✳️ Tips for your application

- If the repayment amount showing at the start of the loan application is different from what you've calculated, don't worry. You'll get confirmation of your interest rate and repayment amount when you chat with one of our Lenders.

- Complete your application in one go! If you leave partway through, the application won't save.

- Have a copy of your recent payslip ready to upload, along with a good idea of your monthly expenses to make it easier.

Normal lending criteria and a $100 establishment fee applies to all new loans. Fees and interest rates are available at www.policecu.org.nz.

Copies of our current Terms and Conditions and Product Disclosure Statement are available from the Police and Families Credit Union. These can be viewed at policecu.org.nz, or by calling 0800 429 000.

The Police Credit Union is not a registered bank.