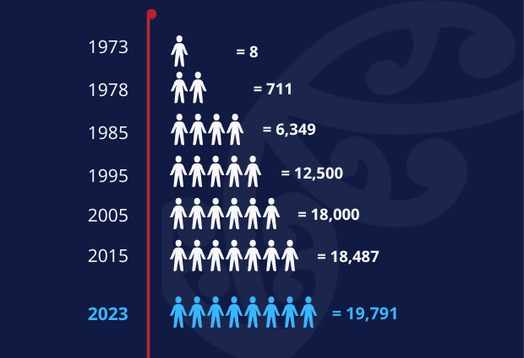

From a kitchen table of eight to a membership of over 19,700, we've come a long way!

Let's reflect on where we started, our challenges and milestones over the years, and celebrate where we are today.

1970's

Born around a humble kitchen table, our journey began with a small passionate group of police officers. Facing inflation and shifts in the labour market, there was a growing desire among our community for a financial institution that catered specifically to the needs of Police.

The 1977 PCU AGM was held in a car at the Waring Taylor Street Police Headquarters and in 1978 our first Board of Directors was established.

1980's

In the dynamic 1980s, amidst significant economic reforms and technological advancements, we ventured into computing with the acquisition of a 'one minicomputer to rule them all.'

After reviewing numerous machines, with quotes ranging from $37,000 to $115,000 (740K – 2.3M by today’s standards), and even a journey to the USA, we were ready to tackle the decade with newfound efficiency.

In 1987, rates in NZ peaked with a home loan floating rate of 20.50% in June and a 6-month term deposit rate of 18% in July.

1990's

During economic turbulence in New Zealand, innovations like touch-tone banking showcased our commitment to member satisfaction in the 1990s. One Board member hailed touch-tone banking as "The most exciting advancement for our organization and members.”

In 1992 we began offering second mortgages and held a new record of $10m in member funds.

In the late 90's we introduced our Bluenotes Newsletter to keep our 15,000 members informed and engaged with PCU activities.

2000's

Despite the uncertainty, Y2K was a non-issue thanks to our thorough compliance and system testing.

In the 2000's we launched our first 'Accesscard' as well as savings accounts just for kids.

Telephone banking was going well, with over 15,000 calls each month!

We survived the global financial crisis in 2008 due to our balanced growth approach and focus on asset quality during a volatile economic environment.

2010's

Throughout the 2010s, amid New Zealand’s economic recovery post the 2008 global financial crisis, we prioritised innovation and sustainability. Responding to shifting behaviour, we adapted our offerings to meet our member needs.

In 2014, we launched our scholarship programme, and in 2016, we began providing free financial capability courses to all NZ Police employees. These initiatives aimed to support our members and their financial wellbeing.

2018 saw a significant rebrand which included changing our trading name from the ‘Police and Families Credit Union’ to the ‘Police Credit Union’. The rebrand was driven by reflecting a modern representation of family and was simplified with the koru symbolising inclusion, perpetual movement and renewal.

2020 to today

Dealing with global challenges, including Covid-19, as well as the cost of living and inflation, we continued to expand and innovate by launching two new home loan products in 2022:

‘Retire Easy’ to help members live the retirement they deserve, and ‘First Home TOGETHER’, a product unique to New Zealand to support members to get into their first home, faster.

In February 2023, Police Credit Union members approved the biggest change to our rules in our 50 years, allowing us to grow our membership.

First, we expanded our definition of family to include parents, grandparents, siblings, nieces and nephews and more.

The second change allows organisations similar to the Police to become PCU members, starting with the NZ Defence Force, which officially launched on 1 February 2024. We're proud to offer our products and services to an organisation that works alongside our Police members regularly and reflects the same underlying values of keeping Kiwis safe.

Supporting you and your whānau

Technology may have changed quite a bit in the last 50 years, but what hasn't changed is our purpose of helping Police and their families.

Take a look at everything we offer designed to support you and your whole family right from birth through to retirement.

Membership Growth

Starting with a group of eight, the Police Credit Union has grown to a strong membership of 19,791.

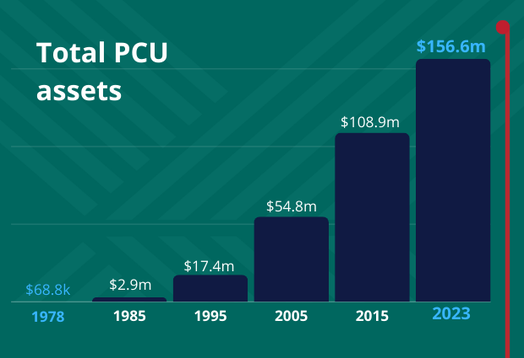

Total Credit Union Assets

From $68,832 in 1978, our total assets have continued to climb over the years, with a total of $156.6m in 2023.

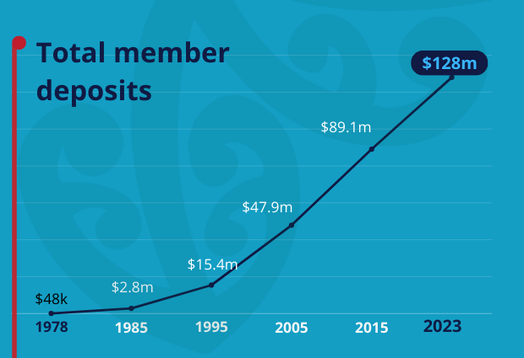

Member Deposits

As our membership grew, so did the savings and investments members held with us, seeing us with a total of $128m in 2023.